Getting The Hard Money Atlanta To Work

Wiki Article

The Only Guide to Hard Money Atlanta

Table of ContentsHard Money Atlanta for BeginnersThe Ultimate Guide To Hard Money AtlantaHard Money Atlanta for DummiesHard Money Atlanta Fundamentals ExplainedEverything about Hard Money Atlanta

These projects are typically finished swiftly, hence the need for quick accessibility to funds. Benefit from the task can be utilized as a down payment on the following, for that reason, tough money loans permit financiers to scale and also turn more properties per time - hard money atlanta. Considered that the fixing to resale timespan is short (normally much less than a year), home flippers do not need the long-lasting car loans that traditional home mortgage lending institutions offer.Conventional lenders may be taken into consideration the antithesis of hard money lending institutions. What is a hard money lender?

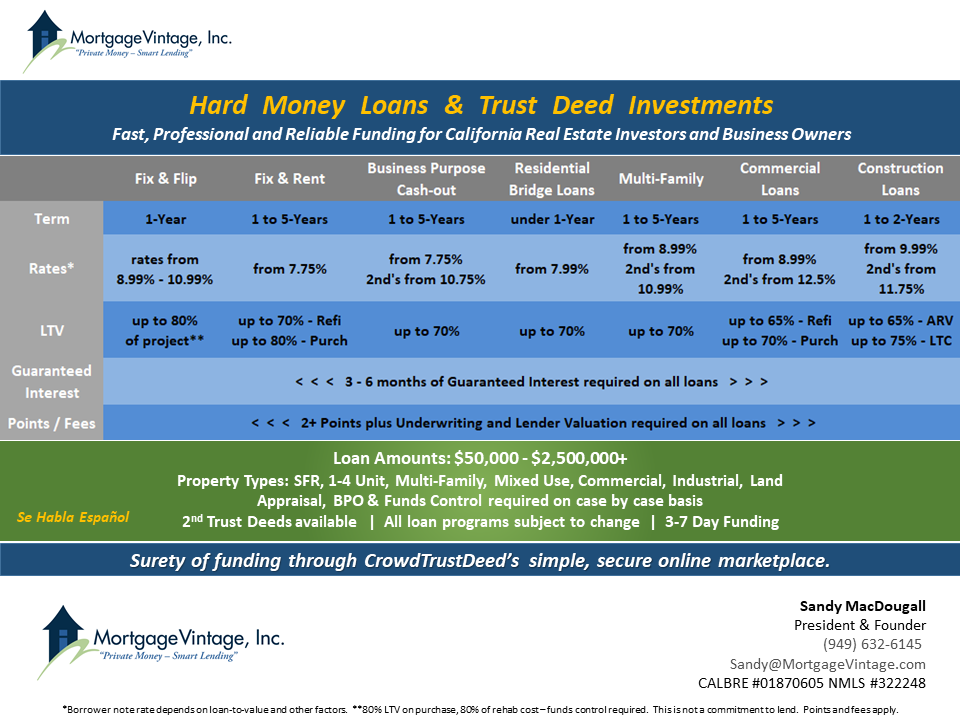

Typically, these factors are not the most essential consideration for loan certification (hard money atlanta). Instead, the worth of the property or asset to be acquired, which would additionally be made use of as collateral, is mostly taken into consideration. Rates of interest might likewise vary based on the lender as well as the sell inquiry. Many loan providers may bill rate of interest varying from 9% to even 12% or more.

Hard cash lending institutions would certainly likewise charge a fee for offering the financing, and these charges are additionally referred to as "points." They usually wind up being anywhere from 1- 5% of the total financing sum, however, points would usually equate to one portion factor of the finance. The significant distinction in between a tough cash lender and also other loan providers hinges on the approval process.

10 Easy Facts About Hard Money Atlanta Shown

A difficult money loan provider, on the other hand, concentrates on the property to be purchased as the leading factor to consider. Credit history scores, earnings, and also various other individual requirements come secondary. They likewise vary in regards to ease of accessibility to financing as well as rate of interest; difficult money lenders offer funding swiftly as well as bill greater rate of interest rates also.You could locate one in among the adhering to methods: An easy net search Request referrals from neighborhood property agents Request referrals from real estate financiers/ investor teams Given that the car loans are non-conforming, you need to take your time evaluating the demands as well as terms offered before making a calculated and also notified choice.

It is necessary to run the figures before deciding for a hard cash financing to ensure that you do not encounter any loss. Look for your hard money loan today as well as obtain a finance dedication in 1 day.

These loans can usually be obtained quicker than a conventional car loan, and also often without a huge deposit. A hard cash car loan is a collateral-backed finance, safeguarded by the property being bought. The size of the car loan is figured out by the approximated worth of the residential property after suggested repair services are have a peek at this site made.

The smart Trick of Hard Money Atlanta That Nobody is Talking About

The majority of hard money financings have a regard to six to twelve months, although in some circumstances, longer terms can be organized. The borrower makes a monthly settlement to the lending institution, usually an interest-only payment. Here's how a common tough money loan works: The customer desires to purchase a fixer-upper for $100,000.

Some lenders will certainly call for even more cash in the deal, as well as ask for a minimum down settlement of 10-20%. It can be advantageous for the investor to seek the lending institutions that need minimal down repayment alternatives to lower their cash to shut. There will certainly likewise be the normal title charges related to closing a deal.

See to it to check with the tough cash lending institution to see if there are prepayment charges charged or a minimum yield they call for. Assuming you are in the finance for 3 months, and the property costs the forecasted $180,000, the financier makes an earnings of $25,000. If the property costs more than $180,000, the customer makes more money.

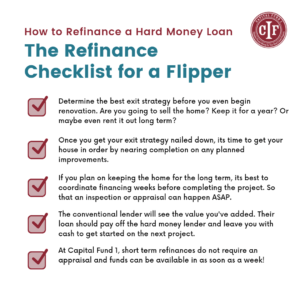

As a Visit Your URL result of the much shorter term and high rate of interest, there usually needs to be remodelling as well as upside equity to record, whether its a flip or rental residential or commercial property. First, a hard money funding is excellent for a customer who wishes to repair and also flip an underestimated residential property within a reasonably brief time period.

Excitement About Hard Money Atlanta

It is crucial to know how difficult money financings work and just how they differ from conventional loans. These traditional lenders do not typically deal in difficult money fundings.

The Greatest Guide To Hard Money Atlanta

When applying for a tough cash finance, customers need to prove that they have enough funding to successfully get through a deal. (ARV) of the home that is, the estimated value of the property after all enhancements additional resources have actually been made.Report this wiki page